The gig economy has become a big part of how many people work today. Jobs like delivering food, driving rideshare cars, freelancing online, and renting out property through apps give people new ways to make money. These jobs are flexible, allowing workers to choose their hours and projects. But while the gig economy offers freedom, it also comes with challenges, especially when it comes to money. Gig workers don’t always have steady paychecks, benefits like health insurance, or protections that regular employees might have. Learning how to handle these risks is important to stay financially secure.

What Is the Gig Economy?

The gig economy is made up of temporary or freelance jobs. Instead of working for one employer full-time, gig workers do short-term tasks or projects. These jobs are often found through apps or websites. For example, someone might drive for a rideshare company, deliver groceries, or design logos for businesses online. Many people enjoy the freedom of gig work because it lets them choose when and how they work. However, this freedom comes with uncertainty because income can go up and down depending on how many jobs are available or how much demand there is for a service.

The Risks of Working in the Gig Economy

One of the biggest risks gig workers face is inconsistent income. Unlike regular jobs, where people get the same paycheck every week or month, gig workers might earn a lot one week and very little the next. This makes it hard to plan for regular expenses like rent, food, and bills. Gig workers also don’t usually get benefits like health insurance, retirement savings plans, or paid sick leave. If a gig worker gets sick or their car breaks down, they might not have the money to cover unexpected costs.

Another risk is taxes. Gig workers are often considered self-employed, meaning they have to pay their own taxes. This is different from regular jobs, where employers take taxes out of paychecks automatically. Gig workers have to save part of their earnings to pay taxes later, and many people forget to do this, which can lead to trouble when taxes are due.

How to Manage Financial Risks

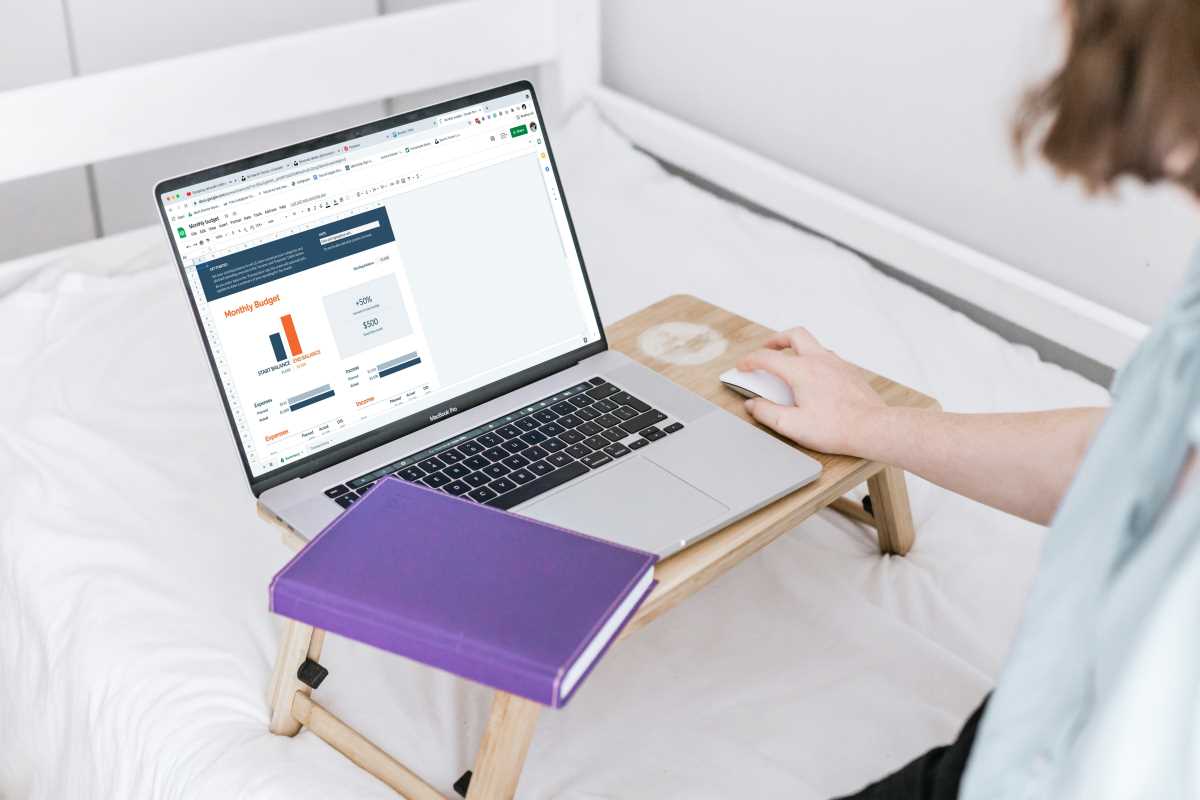

Managing money as a gig worker starts with creating a budget. A budget helps track how much money is coming in and how much is going out. Since income can change from month to month, it’s smart to save during the good months to cover expenses during slower times. Setting aside an emergency fund can also help. This is a savings account with enough money to cover a few months’ worth of expenses. Having an emergency fund can keep you from falling into debt when something unexpected happens.

It’s also important to keep track of your taxes. Gig workers should save around 20-30% of their income for taxes, depending on their country or state. Some apps and websites can help calculate how much you need to save. Paying estimated taxes every few months can also make things easier when tax season comes.

Health insurance and retirement savings are other things gig workers need to think about. While these aren’t usually provided by gig platforms, there are ways to get them. For example, you can buy your own health insurance plan or set up a retirement account, such as an Individual Retirement Account (IRA). Even putting a small amount of money into these plans regularly can make a big difference over time.

Using Technology to Stay on Track

There are many tools and apps that can help gig workers manage their finances. Budgeting apps, like Mint or YNAB (You Need a Budget), can track income and expenses automatically. Tax apps, like QuickBooks Self-Employed, can help calculate how much to save for taxes and even track mileage for gig workers who drive. Some apps also offer ways to save small amounts of money automatically, which can be helpful for building an emergency fund or saving for retirement.

Knowing When to Ask for Help

Managing money on your own can be hard, and sometimes it’s okay to ask for help. Financial advisors or planners can give advice tailored to your situation. Many communities also have free or low-cost resources, like workshops or online courses, that teach money management skills. Talking to other gig workers can also be helpful. They might share tips or ideas that you hadn’t thought of before.

Balancing Freedom and Responsibility

The gig economy offers the freedom to work on your own terms, but this comes with the responsibility of managing your own finances. Taking the time to create a budget, save for taxes, and plan for the future can make gig work more sustainable in the long run. While it can be tempting to spend all your earnings during good months, staying disciplined with saving and planning will pay off, especially during tough times.