Budgeting is a crucial aspect of managing your finances effectively. It can help you achieve your financial goals, whether it's saving for a vacation, buying a home, or paying off debt. Creating a budget and sticking to it can be challenging, but with the right strategies, you can take control of your money and secure your financial future. Here are some expert tips to help you create and stick to your budget.

Start by tracking your expenses: Before you create a budget, it's essential to understand where your money is going. Take the time to track all your expenses for a month to get a clear picture of your spending habits. This will help you identify areas where you can cut back and save money.

Set realistic goals: When creating a budget, it's crucial to set realistic financial goals. Whether you want to save a certain amount each month, pay off debt, or increase your retirement contributions, make sure your goals are achievable. Setting realistic goals will help you stay motivated and focused on sticking to your budget.

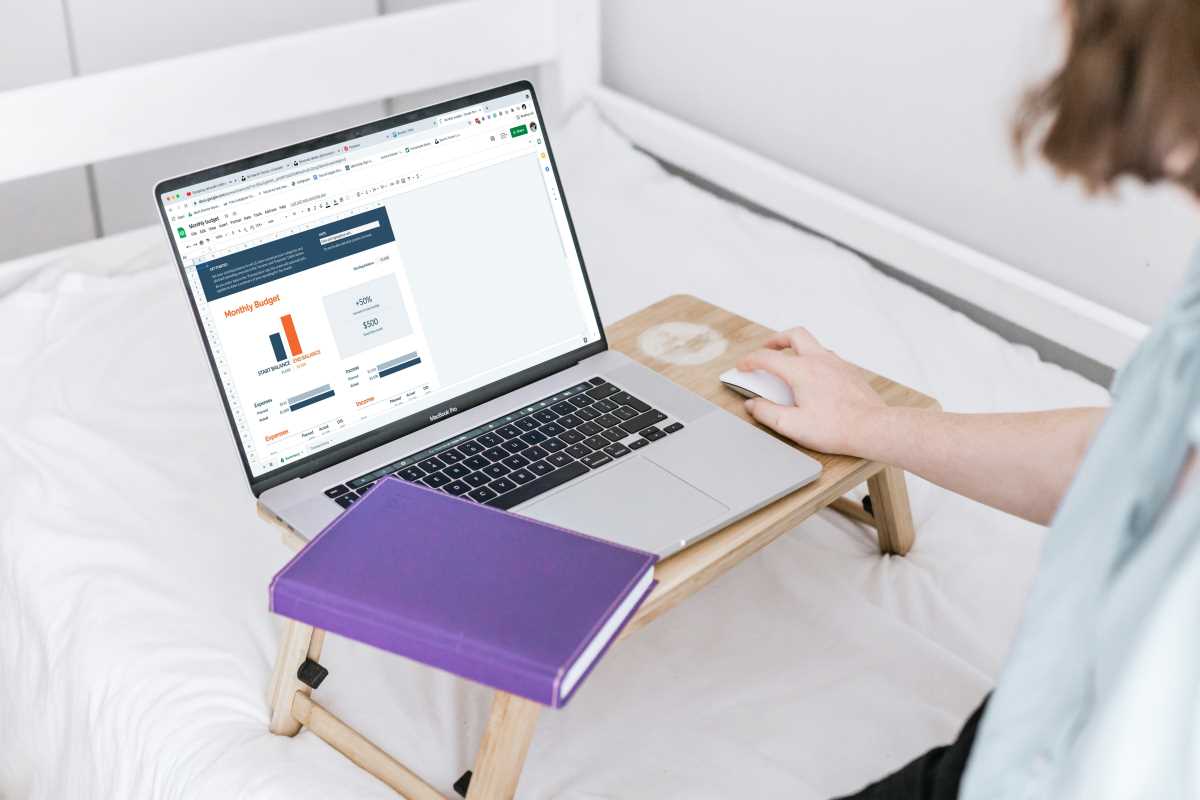

Use budgeting tools: There are many budgeting tools and apps available that can help you track your expenses, set financial goals, and monitor your progress. Whether you prefer a spreadsheet, a budgeting app, or a financial planning tool, find a method that works best for you and helps you stay organized.

Cut back on non-essential expenses: One of the most effective ways to stick to your budget is to cut back on non-essential expenses. Look for ways to reduce spending on items like dining out, entertainment, and shopping. Consider meal prepping at home, finding free or low-cost activities for entertainment, and limiting impulse purchases to stay within your budget.

Monitor your progress regularly: Once you've created a budget, it's essential to monitor your progress regularly. Review your spending, track your savings goals, and make adjustments as needed to stay on track. Regularly checking in on your budget will help you stay accountable and make necessary changes to achieve your financial goals.

Plan for unexpected expenses: Life is full of surprises, and unexpected expenses can derail even the most well-thought-out budget. To avoid going off track, it's essential to plan for unexpected expenses by building an emergency fund. Set aside a portion of your income each month to cover unexpected costs like car repairs, medical bills, or home maintenance.

Seek professional help if needed: If you're struggling to create or stick to your budget, don't hesitate to seek help from a financial advisor or a credit counselor. These professionals can provide personalized advice, help you set realistic financial goals, and develop a budget that works for your unique situation.

By following these expert tips, you can create a budget that works for you and stick to it to achieve your financial goals. Remember that budgeting is a skill that takes time to develop, so be patient with yourself and stay committed to improving your financial well-being.

(Image via

(Image via