Personal Finance Basics are essential for anyone looking to take control of their financial future. Whether you're just starting out in your career or looking to make the most of your hard-earned money, understanding the fundamentals of personal finance can set you on the path to financial success. Here are some key topics to consider when navigating the world of personal finance.

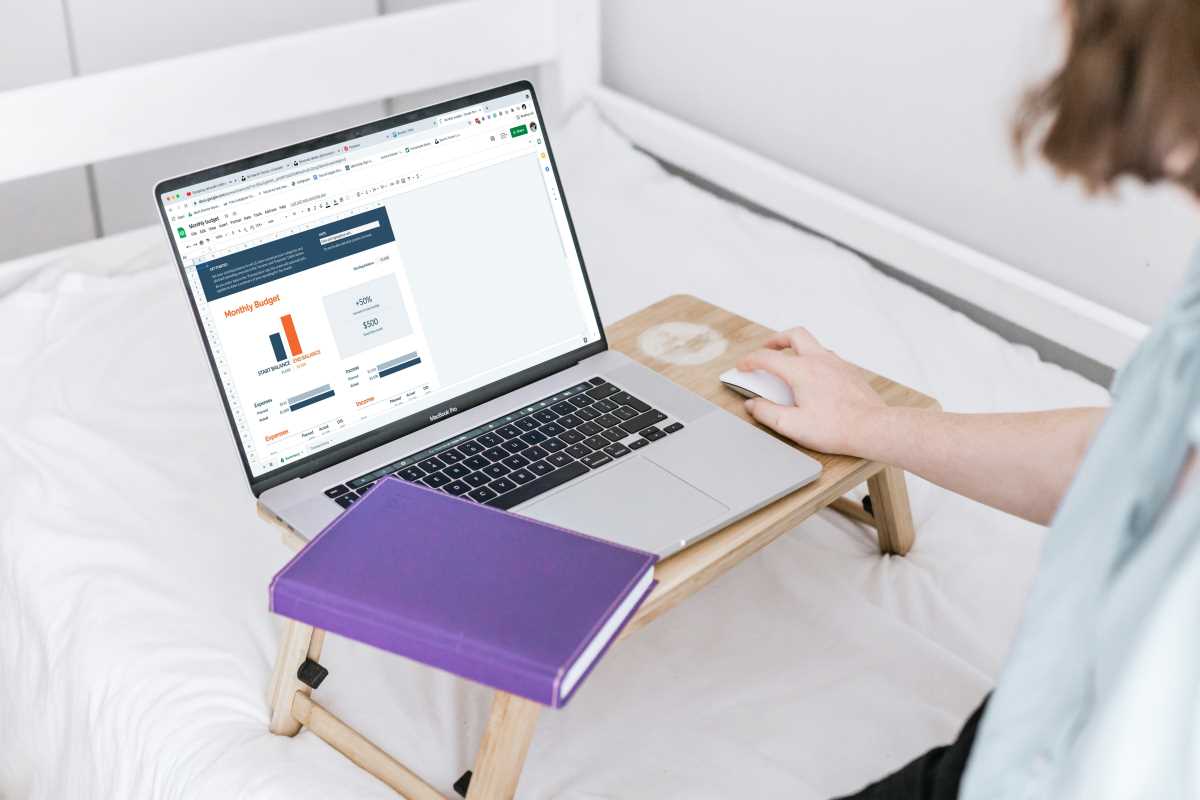

Creating a Budget is the foundation of good financial planning. By tracking your income and expenses, you can gain a clear picture of where your money is going each month. Remember, it's not about how much you make, but how much you spend within your means. Setting financial goals within your budget can help you save for big-ticket items or plan for the future.

Emergency Savings are crucial for unexpected expenses or financial emergencies. It's recommended to have at least three to six months' worth of living expenses saved in case of job loss or unforeseen circumstances. By setting aside a portion of your income each month, you can build a safety net for peace of mind.

Understanding Credit and Debt is important for managing your financial health. It's essential to know your credit score, as it impacts your ability to secure loans, credit cards, or mortgages. Be wary of accumulating high-interest debt, such as credit card balances, and aim to pay off debts quickly to avoid costly interest charges.

Investing for the Future is a key component of personal finance. By saving and investing for retirement early on, you can take advantage of compound interest and grow your wealth over time. Consider enrolling in your employer's retirement plan, such as a 401(k) or IRA, and diversify your investments to minimize risk.

Insurance Protection is crucial for safeguarding your financial well-being. Health insurance can help cover medical expenses, while property insurance protects your assets, such as your home or car, from unforeseen damages. Consider other types of insurance, such as life insurance or disability insurance, to provide financial security for your loved ones in case of unexpected events.

Estate Planning involves creating a plan for your assets and belongings in case of incapacitation or death. By having a will, trust, or power of attorney in place, you can ensure that your wishes are carried out and your loved ones are provided for. Estate planning also involves minimizing estate taxes to preserve your wealth for future generations.

By mastering these Personal Finance Basics, you can take control of your financial future and make informed decisions about your money. Remember, financial planning is a lifelong journey, so take the time to educate yourself, seek professional advice when needed, and stay proactive in managing your finances. With dedication and discipline, you can achieve your financial goals and build a secure financial foundation for the years to come.

(Image via

(Image via