Saving money is an essential component of financial well-being for many adults. Developing smart strategies for building your savings can help you achieve your financial goals and provide a sense of security for the future. Here are some tips to help you build your savings effectively.

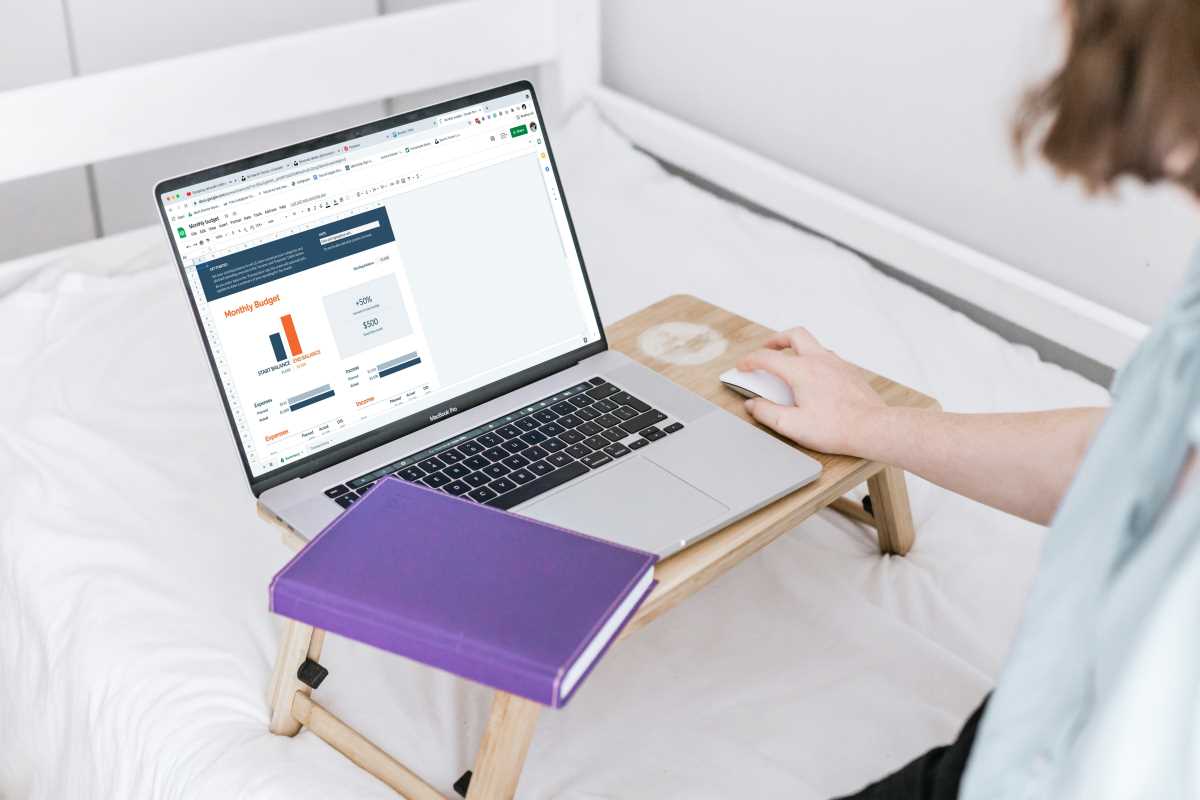

Create a Budget: One crucial step in building your savings is creating a budget. Start by listing your monthly income and expenses. Differentiate between essential expenses like rent, utilities, and groceries, and non-essential expenses such as dining out or shopping. Allocate a portion of your income to savings each month.

Automate Your Savings: Take advantage of technology by setting up automatic transfers from your checking account to your savings account. This way, you won't have to remember to manually transfer money each month, making it easier to build your savings without much effort.

Cut Down on Unnecessary Expenses: Identify areas where you can cut down on unnecessary expenses to free up more money for savings. This could mean reducing the number of times you eat out each month, cancelling unused subscriptions, or finding cheaper alternatives for your regular expenses.

Start an Emergency Fund: It's important to have an emergency fund to cover unexpected expenses like medical bills, car repairs, or job loss. Aim to save 3-6 months' worth of living expenses in your emergency fund to ensure you are prepared for any unforeseen circumstances.

Set Savings Goals: Whether you are saving for a vacation, a down payment on a house, or retirement, setting specific savings goals can help you stay motivated. Break down your goals into smaller, more manageable targets, and track your progress regularly to stay on course.

Invest Wisely: Once you have built a solid savings foundation, consider exploring investment options to help your money grow. Consult with a financial advisor to determine the best investment opportunities based on your financial goals and risk tolerance.

By implementing these smart strategies for building your savings, you can take control of your financial future and work towards achieving your long-term goals. Remember that building savings is a gradual process, so stay patient and consistent in your efforts to see positive results over time.

(Image via

(Image via